College American Economics Worksheet

Description

Question 13 pts

Consumers will be affected if the government imposes a tax on apples because

Group of answer choices

consumer surplus would increase.

the price of apples would increase and fewer apples would be purchased.

revenues for apple growers would decrease.

the government would collect revenue from the tax.

producer surplus would decrease.

Flag question: Question 2

Question 23 pts

In most cases, taxes make markets less efficient because

Group of answer choices

they lower prices for consumers and cause firms to suffer.

they increase firms profits at the expense of consumers.

taxes are perceived as unfair by some taxpayers.

the government often spends tax revenues on programs that some voters dont like.

they reduce consumer surplus and producer surplus.

Flag question: Question 3

Question 33 pts

Taxes cause

Group of answer choices

both consumer and producer prices to increase.

the consumer price to increase but leave producer prices unchanged.

both consumer and producer prices to decrease.

the consumer price to decrease and the producer price to increase.

the consumer price to increase and the producer price to decrease.

Flag question: Question 4

Question 43 pts

After a tax is imposed, the difference between the price that consumers pay and the price that sellers receive equals

Group of answer choices

loss of social welfare from the tax.

per unit tax.

deadweight loss from the tax.

revenue from the tax.

lost profit from the tax.

Flag question: Question 5

Question 53 pts

What is the tax incidence?

Group of answer choices

who pays the tax out of pocket.

how much tax revenue the tax generates.

who bears the burden of the tax.

how the tax revenue from the tax is spent.

government efficiency in providing goods and services.

Flag question: Question 6

Question 63 pts

The DWL from a tax will be smaller when a product has

Group of answer choices

few complements.

many substitutes.

few substitutes.

an elastic demand.

an elastic supply.

Flag question: Question 7

Question 73 pts

The incidence of a tax is determined by

Group of answer choices

which side of the market is less sensitive to a change in price

who pays the tax out of pocket.

whether the supply curve or demand curve shifts as a result of the tax.

how much tax revenue it generates.

how much paperwork there is to complete.

Flag question: Question 8

Question 83 pts

As the size of a tax rate increases, eventually

Group of answer choices

supply can outweigh demand.

willingness to pay can outweigh deadweight loss.

demand can outweigh supply.

deadweight loss can outweigh tax revenue.

tax revenue can outweigh willingness to sell.

Flag question: Question 9

Question 93 pts

If the government puts a tax on the buyers of milk, then

Group of answer choices

buyers will bear the entire burden of the tax.

sellers will bear the entire burden of the tax.

buyers and sellers will share the burden of the tax.

the government will bear the entire burden of the tax.

Flag question: Question 10

Question 103 pts

The decrease in total surplus that occurs after a tax is imposed is called

Group of answer choices

wedge loss.

revenue loss.

deadweight loss.

consumer surplus loss.

Flag question: Question 11

Question 113 pts

Which of the following will decrease when the government puts a tax on a product?

Group of answer choices

the equilibrium quantity in the market for the good, the effective price of the good paid by buyers, and consumer surplus

the equilibrium quantity in the market for the good, producer surplus, and the well-being of buyers of the good

the effective price received by sellers of the good, the wedge between the effective price paid by buyers and the effective price received by sellers, and consumer surplus

None of the above is necessarily correct unless we know whether the tax is levied on buyers or on sellers.

Flag question: Question 12

Question 123 pts

The difference between social cost and private cost is the

Group of answer choices

loss in profit to the seller as the result of a negative externality.

external cost of an externality.

cost reduction when the negative externality is eliminated.

cost incurred by the government when it intervenes in the market.

Flag question: Question 13

Question 133 pts

Why do corrective taxes avoid the inefficiencies of most other taxes?

Group of answer choices

Corrective taxes apply only to goods that are bad for people’s health, such as cigarettes and alcohol.

Because corrective taxes take into consideration the costs to bystanders.

Corrective taxes provide incentives for the conservation of natural resources.

Corrective taxes do not affect deadweight loss.

Flag question: Question 14

Question 143 pts

After a tax is imposed, the price paid by consumers ________ and the price received by sellers ________.

Group of answer choices

increases; increases

increases; decreases

decreases; increases

decreases; decreases

is unaffected; is unaffected

Flag question: Question 15

Question 153 pts

Externalities

Group of answer choices

make markets inefficient.

cause equilibrium prices to be too high.

benefit producers at the expense of consumers.

cause equilibrium prices to be too low.

Flag question: Question 16

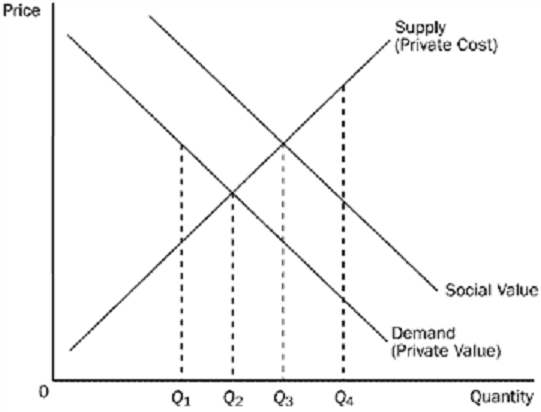

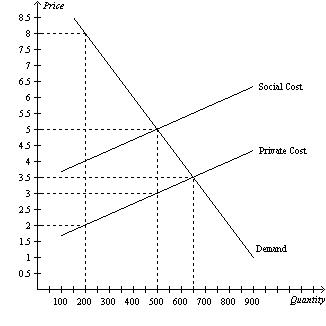

Question 163 pts

Which quantity is socially optimal?

Flag question: Question 17

Question 173 pts

To internalize the externality in this market, the government should

Group of answer choices

impose a tax on this product.

provide a subsidy for this product.

forbid production.

produce the product itself.

Flag question: Question 18

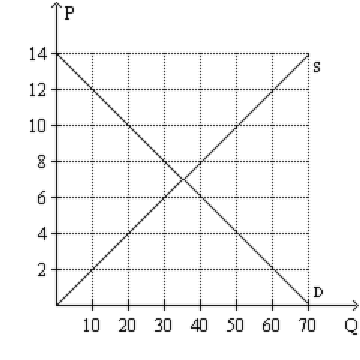

Question 1810 pts

Assume a tax of $6 per unit is imposed on this market.

- What will be the new quantity exchanged in this market?

- What will be the new price that buyers pay?

- What will be the new price that sellers receive?

- How much of the tax will buyers pay?

- How much of the tax will sellers pay?

Flag question: Question 19

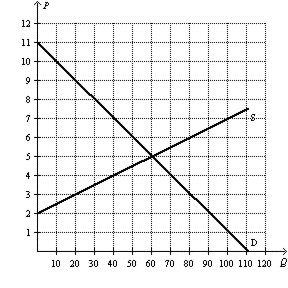

Question 1915 pts

The government adds a $3 tax to this market.

Calculate the following:

Consumer Surplus =

Producer Surplus =

Tax Revenue =

Total Surplus =

Dead Weight Loss =

Flag question: Question 20

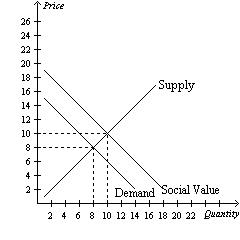

Question 2012 pts

a. What is the external cost?

b. What is the external benefit?

c. Is the private market doing too much or too little in the first

graph?

d. Is the private market doing too much or too little in the second graph?

Flag question: Question 21

Question 213 pts

Suppose a tax was reduced from $6.00 to $3.00. Compared to the $6.00 tax, the lower tax would

Group of answer choices

increase tax revenue and increase the deadweight loss from the tax.

increase tax revenue and decrease the deadweight loss from the tax.

decrease tax revenue and increase the deadweight loss from the tax.

decrease tax revenue and decrease the deadweight loss from the tax.

tax revenue would stay the same and decrease the deadweight loss from the tax

Have a similar assignment? "Place an order for your assignment and have exceptional work written by our team of experts, guaranteeing you A results."